I'll bet you can think of a dozen activities more enticing than nailing down a dynamite budget. Happy hour, beach football and picking up chicks at the dog park all come to mind. But I'm here to show every self-respecting lesbian worth her weight in cargo pants that just like you can't plan a camping trip without the proper equipment, you can't spend your hard-earned cash without employing a top-notch budget.

Now before you run away screaming, hear me out. Budgeting is actually really easy. If you have the time to bore cyberspace with all of your Twitter updates, you have time to control your finances. And I know that it works because rich people do it!

So first we need a little motivation. What are you working toward? What are your goals? Do you want to take a trip to Europe and check out Amsterdam? Do you want to save for a brand new truck with a bumper sticker that says, "Yes, I'm a lesbian and No, I won't help you move?" Are you saving to buy your dream home or are you just trying to pay off debt?

No matter what it is, get started with a goal, a dollar amount and a time frame, if applicable. The more you work within your budget the easier it will be to accomplish your goal. It's all about self-control ladies. Besides, responsibility is sexy!

Budget boot camp time! Now don't be scared. Remember; it's not a diet-it's a lifestyle change. There is no rule in the lesbian handbook that says you have to hit up every gay happy hour in town, running up your credit and debit cards until you're barely making rent. Everything is fine in moderation and you're not going to find Ms. Right at the same dive bar you closed down last week. So get ready to scale down your unnecessary spending.

First thing to do is go CSI on your statements. If this budget is going to work you'll need an accurate picture of what your sources of income bring in and what your expenses take out. It can feel like your bank account is a revolving door but with a little work and a bit of willpower, you can slow down the ride and start saving.

more on next page...

\\\

(continued)

Next, divide your expenses into two categories: fixed and variable. With fixed expenses, the amounts don't change from month to month. These are your rent, car, gym membership and other essentials like your MAXIM Magazine membership. The variable expenses are ones that can change depending on usage like cell phone, utilities or ones you make up like the illustrious keg of the month club.

These are ones you definitely want to keep your eye on. Since you are trying to scale back spending and start saving, consider making a goal for yourself for bills like phone and credit cards. If you found this website you can certainly log on and monitor your transactions to stay in budget. If this means you'll have to wait until next statement cycle to download the latest Lady Gaga ring tone, so be it!

Also take a look at your bank statements for your total income. This includes paychecks for the working stiffs and tips for my go-go dancers out there.

Now that you have all of your monetary ducks in a row it's time to keep track. There are hundreds of websites that offer free budget template downloads. Find one you like and save it to your desktop so that the icon stands as a reminder to your commitment to responsible finance.

Plug in last month's income and expenses and see where you can trim. Many of you may find that you've already broken the cardinal rule of budgeting. If you aren't already accounting for how much you need to save each month to hit your goal, then you are already behind. Remember, pay yourself first, it's the only way! So be sure to transfer the money right away into your savings account or even try to have it done automatically with your payroll department.

If you can do this you might just be able to spring for an actual hotel in Amsterdam rather than a shady hostel, upgrade to the extended cab for your new truck or just feel how light your shoulders seem without the burden of debt weighing them down.

You don't have to go cold turkey; all you have to do is stay tough and results will come. Happy budgeting.

Get more of Jessica's tips on recession proofing.

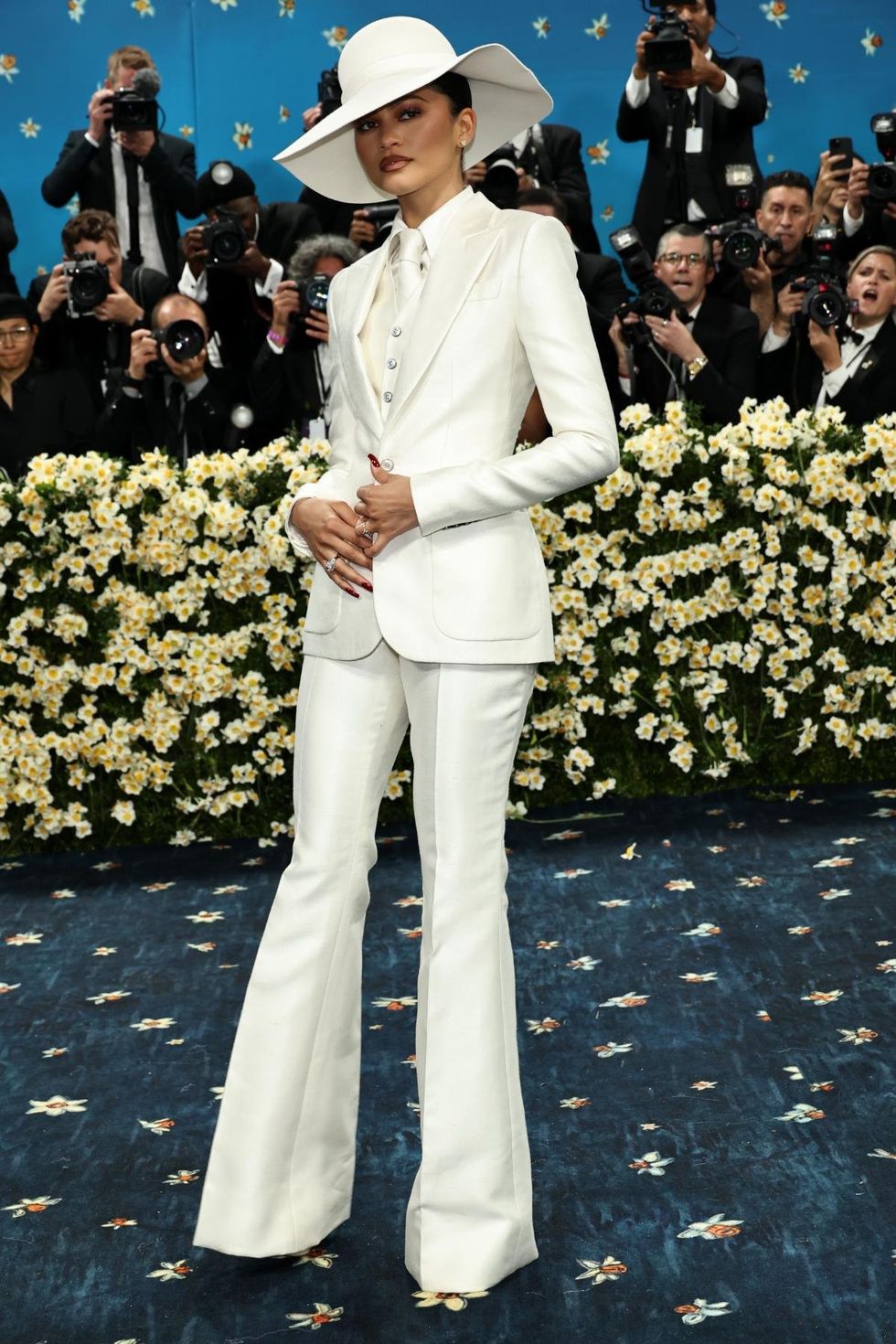

Cindy Ord/Getty Images

Cindy Ord/Getty Images